Medical Groups Challenged with Managing Expenses Amidst Stagnant Revenue New AMGA Operations and Finance Survey Reveals

Alexandria, VA – Data from the recent AMGA 2024 Medical Group Operations and Finance Survey reveal medical groups continue to face challenges related to providing quality, cost-effective care in a constantly evolving healthcare environment. Medical groups continue to feel the strain of internal and external pressures, including rising labor costs, increasing demand/access issues, and regulatory changes, including those from the Centers for Medicare & Medicaid Services (CMS). With a stifled reimbursement environment and continued financial pressures, medical groups are forced to double down on operations and expense management.

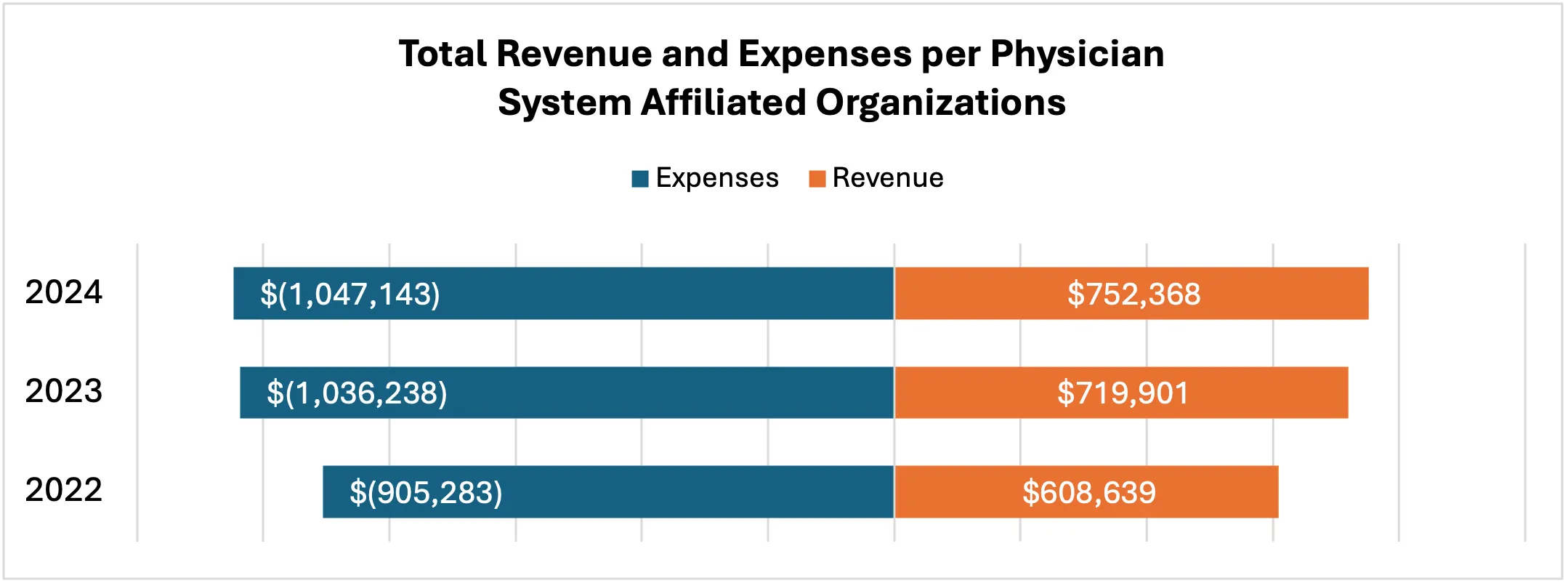

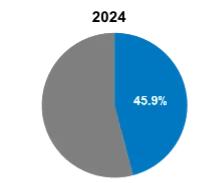

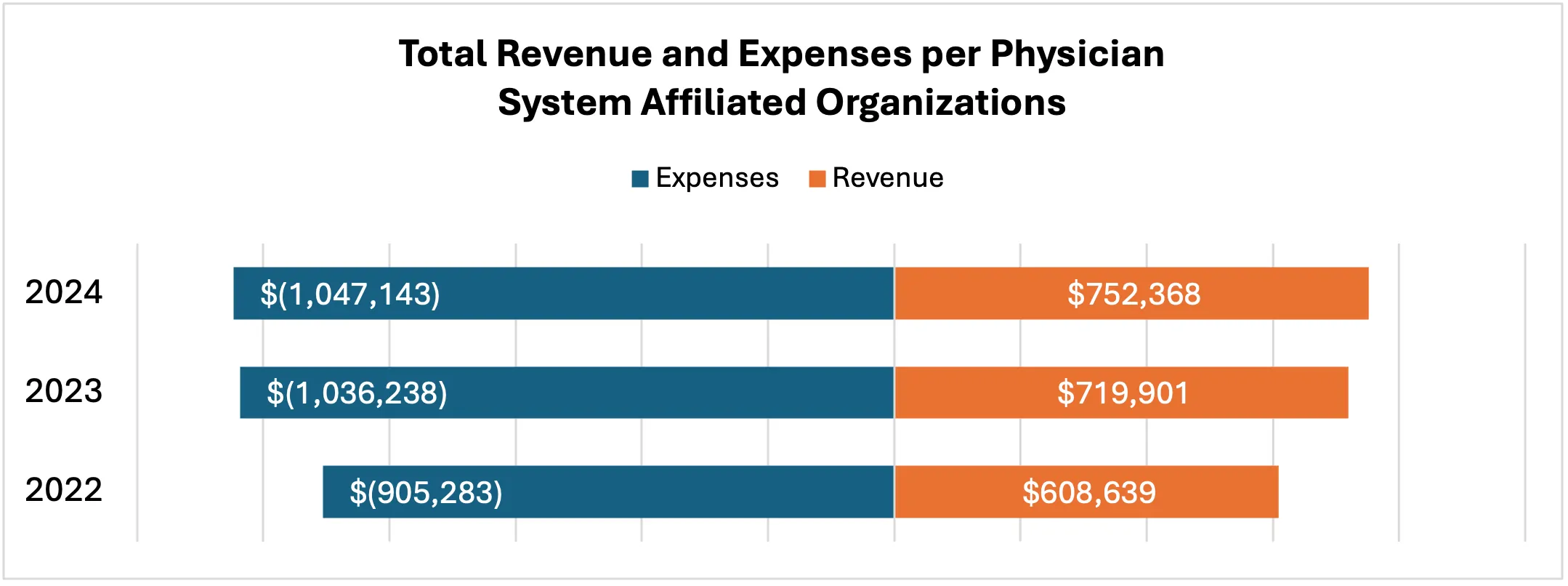

The AMGA 2024 Medical Group Operations and Finance Survey, which features data from over 31,000 providers, captures key performance indicators to support benchmarking and strategic planning. Among the findings, median investment per physician eroded slightly for system-affiliated medical groups, from $249,000 to $256,000 (excluding overhead allocations), as operating expense increases outpaced revenue gains. For system-affiliated groups, the gap continued to widen between revenue and expenses per physician.

“Survey results indicate that ongoing external pressures—such as cost of labor, staffing challenges, and stagnate reimbursement, — are impacting medical group performance,” said AMGA Consulting Chief Operating Officer Mike Coppola, MBA. “Today’s leaders are continually focused on improving operational efficiencies.”

Shift in APC Utilization

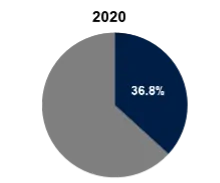

In efforts to address staffing challenges, physician shortages, and access issues, organizations are increasing their utilization of advanced practice clinicians (APCs). Within system-affiliated organizations, APC utilization has grown from 36.8% (2020 AMGA survey) of total providers to 45.9% (2024 AMGA survey). With APCs now close to 50% of the total providers, organizations are also looking at profit/investment per provider (physicians and APCs) to evaluate financial performance within the medical group.

Within system-affiliated groups, median investment per provider (excluding overhead allocations) improved slightly from $175,517 in 2023 to $161,592 in 2024, mainly driven by the inclusion of more APCs (as a percent of the provider workforce) in participating organizations.

“Organizations are very focused on APC recruitment, both in terms of the provision of access and structuring their complement of providers in a more cost-effective manner,” stated Fred Horton, MHA, president of AMGA Consulting.

Expense Percent of Revenue (Per Provider)

As published in the AMGA 2024 Medical Group Compensation and Productivity Survey, provider compensation was up 5.3% overall from the prior year. This increase is also reflected in the 2024 Operations and Finance Survey. When analyzing expenses as a percent of net revenue, salary and benefits increased over last year, while other operating expenses have steadily dropped in recent years. This finding indicates that the portion of the company’s revenue being allocated towards compensation and benefits continues to grow (as a percent of revenue), while expense management in organizations is focused on management of non-salary spending.

Coppola notes, “Medical groups are still challenged by overall inflationary and staffing challenges. We anticipate these challenges to carry into 2025.”

About the Survey

The 2024 edition of AMGA’s Medical Group Operations and Finance Survey features data from more than 7,500 individual clinics and more than 31,000 providers.

This year’s report includes a profile of the survey respondents along with key performance indicators and a focus on benchmark data for both private practice and integrated health system organizations. Metrics are reported per physician FTE, per provider FTE, and per 10,000 work relative value units (wRVUs).

This survey contains data on an expansive list of benchmarks, such as:

-

Operational overhead staffing by functional area and role

-

Revenue cycle key performance metrics

-

Financial performance from high-level summary metrics to line-item detail by clinic type

###

About AMGA Consulting

AMGA Consulting assists healthcare organizations in navigating the changing industry environment. AMGA Consulting builds clients’ organizational capabilities through effective governance, operational improvement, strategic alignment, talent management, provider compensation design, fair market value analysis, and total rewards solutions.

About AMGA

AMGA is a trade association leading the transformation of healthcare in America. Representing multispecialty medical groups and integrated systems of care, we advocate, educate, innovate, and empower our members to deliver the next level of high performance health. AMGA is the national voice promoting awareness of our members’ recognized excellence in the delivery of coordinated, high-quality, high-value care. More than 175,000 physicians practice in our member organizations, delivering care to one in three Americans.

AMGA represents medical groups and integrated systems of care. Its diverse membership includes multispecialty medical groups, integrated delivery systems, accountable care organizations, and other entities committed to improving healthcare outcomes. AMGA advocates for the formation of innovative, clinically integrated systems of care that advance population health, enhance patient experience, and reduce healthcare costs. For more information, please visit www.amga.org.