New AMGA Staffing Survey Reveals Staffing Increases Behind Gains in Productivity

Staffing Composition Reveals Increased Utilization of APCs

Alexandria, VA – While groups continue to add clinical staff to support provider needs, increases to productivity coupled with challenges with patient access overshadow any gains in staffing support. While looking to balance patient demand and physician shortages, medical groups are relying more on advanced practice clinicians (APCs), creating unique challenges to staffing models, especially amid evolving reimbursement environments and value-based care arrangements.

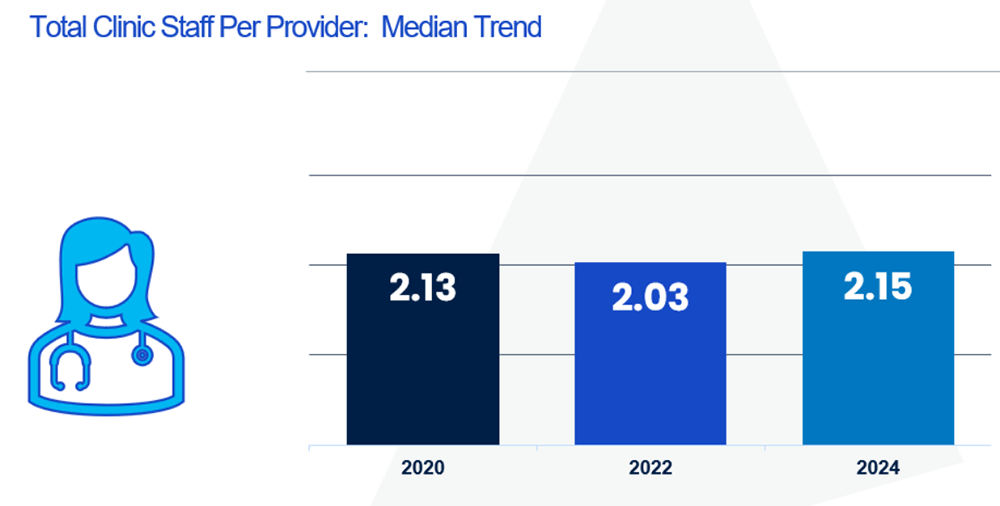

In AMGA’s new 2024 Medical Clinic Staffing Survey, medical groups’ and health systems’ median staffing (on a per-provider basis) is back to pre-COVID levels. Tracking total clinic staff per provider (including both physicians and APCs), the median for all groups is 2.15 total clinic staff FTEs per provider FTE, which is virtually identical to 2020 staff FTEs per provider median of 2.13.

NOTE: Total clinic staff include both front- and back-office clinical staff along with any ancillary or other direct patient care staff. Leadership is excluded.

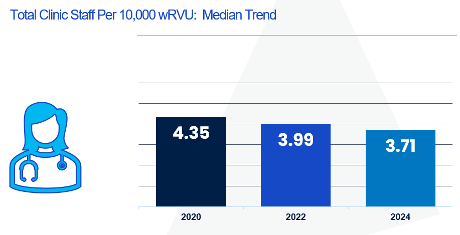

While clinic staff per provider has returned to pre-COVID levels, staffing levels adjusted for productivity (e.g., work relative value units or wRVUs) show a different trend. According to AMGA’s 2024 Medical Group Compensation and Productivity Survey, groups reported an overall 5.2% increase in median productivity (wRVUs) and a 3.0% increase in median visits compared to the prior years’ survey data, while staffing levels only increased 1.3% on a per-provider basis over the same timeframe. Increases in production overshadow any gains in support staffing, which translates to continually decreasing clinic staff per 10,000 wRVUs produced. In 2020, total clinic staff per 10,000 wRVUs was 4.35 FTEs at the median compared to 3.71 total clinic staff FTEs per 10,000 wRVUs today, reflecting a 14.7% decrease in staffing on a volume-adjusted basis.

“It is important to note that productivity-adjusted staffing is artificially deflated due to the Centers for Medicare and Medicaid Services (CMS) changes in wRVU values over the last couple of years,” said AMGA Consulting VP and Chief Operating Officer Mike Coppola. “Medical groups continue to face staffing challenges in the overall economic environment. “

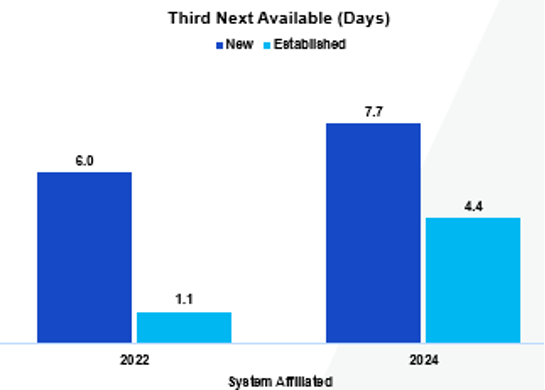

Increasing demand also affects patient access, which continues to be top-of-mind for many medical groups. Tracking access, many groups reported an increase in wait times to schedule appointments and increased schedule utilization. Within system-affiliated groups, wait times for established patients (third next available) have risen from 1.1 days in 2022 to 4.4 days in 2024. Schedule fill rates have increased almost 5% for system-affiliated groups over the same period.

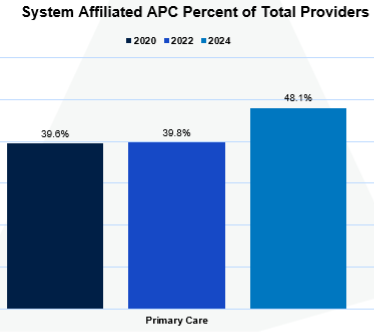

As medical groups look to combat access issues and provider shortages, many organizations continue to look to APCs to fill the gap, especially in states where they can provide care independent of physicians. In 2020, APCs in system-affiliated organizations comprised 39.6% of the provider workforce in primary care. This has grown to 48.1% in the current 2024 survey, showing that almost 8.5% more of the provider workforce is comprised of APCs today than in the 2020 survey.

Increased utilization of APCs, while helping with access, has other implications relative to provider production and staffing roles and responsibilities. Based on data represented in AMGA’s 2024 Medical Group Compensation and Productivity Survey, APCs generate about 77% of physicians’ wRVU productivity. Along with financial implications, evolving roles and responsibilities of APCs and clinical staff to support managed care arrangements create unique challenges when caring for a patient population/panel.

“As organizations continue to refine care models through the use of APCs, there has been continued increase in the percentage of APCs to total providers across all specialties over the last several years. Organizations continue to navigate the varying state regulations on the scope of practice for APCs, while attempting to address overall physician shortages” said Coppola.

About the Survey

The 2024 AMGA Clinical Staffing Survey is a comprehensive report representing more than 7,500 clinics and over 31,000 providers. The survey contains staffing benchmarks for standard clinic staff roles with data presented per physician, per provider, per 10,000 wRVU and per 5,000 visits. To learn more and purchase the survey, visit the AMGA website.

###

About AMGA Consulting

AMGA Consulting assists healthcare organizations in navigating the changing industry environment. AMGA Consulting builds clients’ organizational capabilities through effective governance, operational improvement, strategic alignment, talent management, provider compensation design, fair market value analysis, and total rewards solutions.

About AMGA

AMGA is a trade association leading the transformation of healthcare in America. Representing multispecialty medical groups and integrated systems of care, we advocate, educate, innovate, and empower our members to deliver the next level of high performance health. AMGA is the national voice promoting awareness of our members’ recognized excellence in the delivery of coordinated, high-quality, high-value care. More than 175,000 physicians practice in our member organizations, delivering care to one in three Americans.

AMGA represents medical groups and integrated systems of care. Its diverse membership includes multispecialty medical groups, integrated delivery systems, accountable care organizations, and other entities committed to improving healthcare outcomes. AMGA advocates for the formation of innovative, clinically integrated systems of care that advance population health, enhance patient experience, and reduce healthcare costs. For more information, please visit www.amga.org.